HOW CAN YOU SAVE THOUSANDS IN TAXES?

S-Corp Tax Savings Calculator

Reduce your federal self-employment tax by electing to be treated as an S-Corporation

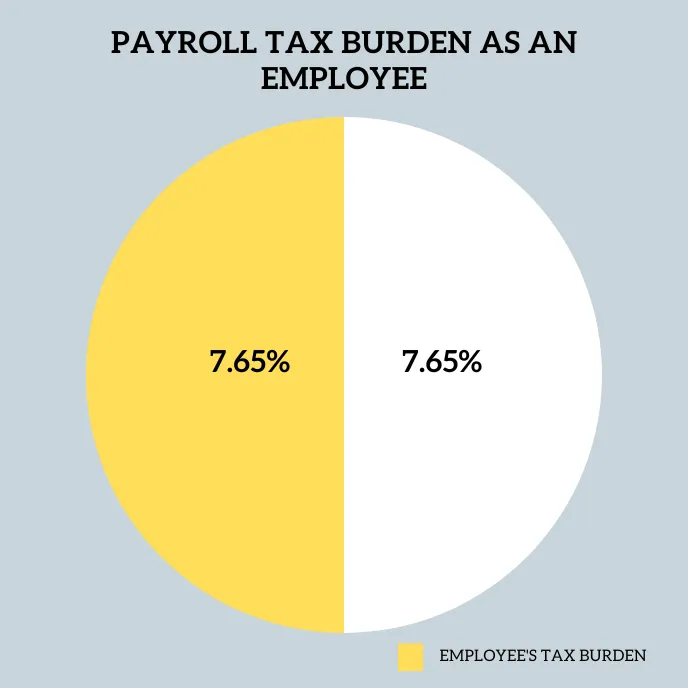

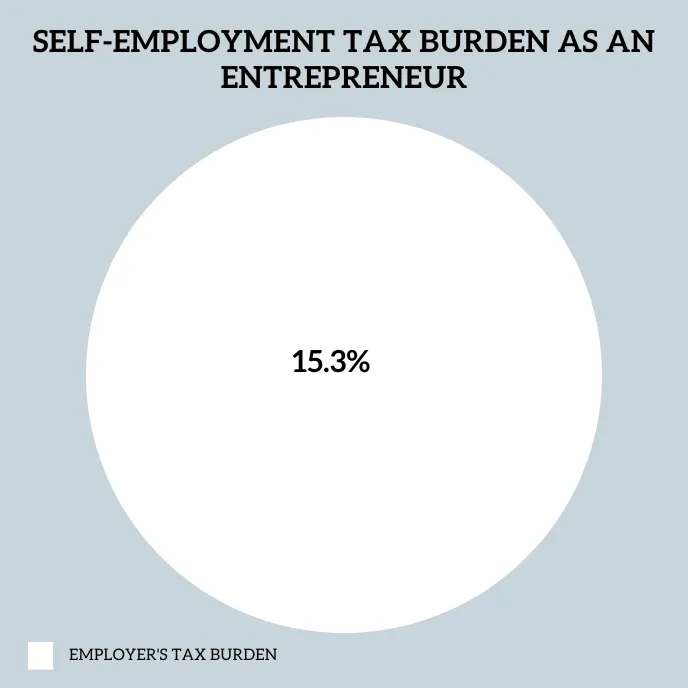

Regardless if you're self-employed or an employee, you have to pay Social Security and Medicare taxes to the government. When you work for someone else, you're only responsible for part of these taxes, while your employer pays the balance (you pay about 7.65% and your employer pays about 7.65%) However, when you're self-employed, you have to pay both portions of this tax, which amounts to about 15.3%.

So how can you save money on your Self-Employed tax burden?

By choosing to be treated as an S-Corp!

Being Taxed as an S-Corp Versus LLC

When you are an LLC or sole proprietor, you have to pay self-employment tax on your entire taxable business income.

If you elect to be taxed as an S-Corp, you have to pay yourself a salary via a paycheck. Those wages are subject to self-employment tax, however the remaining earnings of your business are NOT subject to self-employment tax.

FOR EXAMPLE

If your business has net income of $70,000 and you’re taxed as an LLC, you will owe nearly $10,000 in self-employment tax. However, if you elect to be taxed as an S-Corporation and take a $40,000 salary with the remaining $30,000 being a distribution to you or you keep it in the business, you pay only $6,120 in self-employment tax, saving you nearly $4,000 in self-employment taxes!

Important Notes about S-Corps

You can file the paperwork with the IRS to elect to be taxed as an S-Corp (Form 2553) as long as you already have an LLC established.

Your annual federal S-Corporation tax return is due March 15th in addition to your personal tax return due on April 15th.

There are additional costs of having an S-Corp including payroll fees (budget around $50 per month) as well as tax filing fees depending on your CPA.

This calculation is only valid if your business net income is $147,000 or less – if your projected net income is higher, contact us so we can provide a specialized tax savings projection.

Is an S-Corp right for you?

For more information, click the link below to schedule your S-Corporation Consultation!